Real Estate Investment & Development

INDUSTRIAL | HOSPITALITY | SPECIAL SITUATIONS

A vertically integrated real estate investment company that acquires, develops, and manages assets on behalf of our principals and private investors.

OUR EXPERIENCE & TRACK RECORD

$250M+

REALESTATE ASSETS

ACQUIRED / MANAGED

26

PROPERTIES

+1,500,000

NET RENTABLE

SQUARE FEET

WHY INVEST WITH PAGURIAN

SAFETY

Quality real estate is a safe investment and has historically outperformed the S&P 500.

PASSIVE

You can sit back, relax, and collect passive income for your investment.

TAX BENEFITS

Depreciation is a unique tax write-off that allows you to keep more profits in your pocket.

CASHFLOW

Residents pay rent every month to cover all expenses and provide profits to investors.

LEVERAGE

You can leverage real estate, which allows for the purchase of a $20M asset for as little as $5M.

EQUITY

Real estate in great markets results in value appreciation which further boosts investor returns.

TRANSPARENCY

You receive 100% transparency into our operations so you can feel comfortable.

AMORTIZATION

Residents pay down debt which increases your equity and results in long-term wealth creation.

EXPERIENCE

You, the investor, always have access to our team to talk about your investments.

EXPERTISE

LEADERSHIP

JAMES WRIGHT

FOUNDER OF PAGURIAN

Masters in Business UCLA Anderson

BA Engineering Western Washington University

PAGURIAN PARTNERS was founded by James Wright with a long-term mission: to acquire, develop, and operate tax-advantaged, cash-flowing real estate.

Before launching Pagurian, James was mentored by renowned Orange County entrepreneur Jim Downey, one of Southern California’s most successful self-made business leaders. As part of Downey’s private family office, James contributed to the acquisition and expansion of two aerospace manufacturing companies—helping grow them from $6 million in revenue to more than $300 million in enterprise value:

> EnCore Composite Structures – acquired and later sold to AC&A Enterprises Holdings

> EnCore Aerospace – acquired and ultimately sold to Boeing

In 2013, James shifted his focus from Downey’s ventures to building a permanent capital platform in commercial real estate and private equity. He founded Pagurian to partner with families, operators, and capital providers in creating a portfolio of real assets—with a focus on commercial properties paired with business operations that can deliver outsized returns through active, hands-on management (including self-storage, industrial, car wash, and hospitality assets).

James holds a B.S. in Engineering from Western Washington University and an MBA from UCLA Anderson. He and his family divide their time between Washington State, and Palm Desert, California.

PARTNERS & ADVISORS

ROB HOWIE

PRESIDENT OF SEACON / SEATTLE COMMERCIAL DEVELOPMENT & PAGURIAN PARTNER

Rob is the President and co-founder of SeaCon Construction and Seattle Commercial Development.

SEA CON LLC is the current operating entity of a construction organization that was formed in December 1975 and has operated continuously from that date as SEA CON LLC.

The company offers consulting, management and construction services to commercial & industrial building users. SEA CON LLC’s management and staff represent many years of experience in the building and heavy construction industries with an impressive list of successfully completed projects for clients including: Microsoft, Public Storage, Terex-Genie, Modern Aviation, Signature Aviation and many more.

ANDREW HUNTER

HUNTER INVESTORS / BROKER & ADVISOR

Andrew is a self-storage market specialist who has spent the past seven years facilitating self-storage transactions throughout Oregon and Washington State (most recently with Cushman Wakefield, a top 3 storage brokerage).

His sector knowledge and pre-existing relationships with facility operators gives Pagurian an advantage in deal sourcing, underwriting and in-house disposition of assets.

CULLEN MAHONEY

MULTI-FAMILY DEVELOPER / LAWYER

Cullen is a multi-family developer and lawyer based in Miami, Florida.

After receiving his JD from the University of Miami, Cullen joined Related Group where he spent several years developing and managing some of Miami’s highest profile projects including: Armani Residences (260 units), Terminal Island (160,000 SF), St Regis (354 units), and Miramar (393 units) — with each project independently exceeding hundreds of million in debt and equity.

PAT NOLAN

PAGURIAN ADVISOR

Pat and his wife Amy entered the self-storage business in the 1990’s and became one of the largest privately owned Self-Storage operators in the country. At their peak they owned/operated more than 10,000 units across Texas. In late 2021 the Nolan’s exited a portion of their stabilized portfolio to a public REIT, locking in significant tax advantaged returns while retaining much of the cash-flows that make self-storage investments so attractive.

The Nolan’s continue to invest in storage and other realestate asset classes through both acquisitions and new development.

DEALS & PROJECTS (RECENT)

PAGURIAN FUND

STRATEGIC OPPORTUNITIES

We’re seeing opportunistic dislocations in commercial realestate. The Strategic Opportunities Fund utilizes creative debt & preferred equity structures to achieve highly attractive risk adjusted returns that offer ongoing cash-flow, tax benefits and equity appreciation.

>INDUSTRIAL

>SELF-STORAGE

>HOSPITALITY

GISELLE MIAMI

Giselle Miami, the rooftop restaurant located atop E11EVEN in downtown Miami, officially opened its doors in 2023. Since then, it has been offering a fusion of Asian, Mediterranean, and French-inspired cuisine in a sophisticated setting with panoramic views of the city skyline (Pagurian’s partners have a small LP interest).

CURRENT PROJECTS

SELF-STORAGE

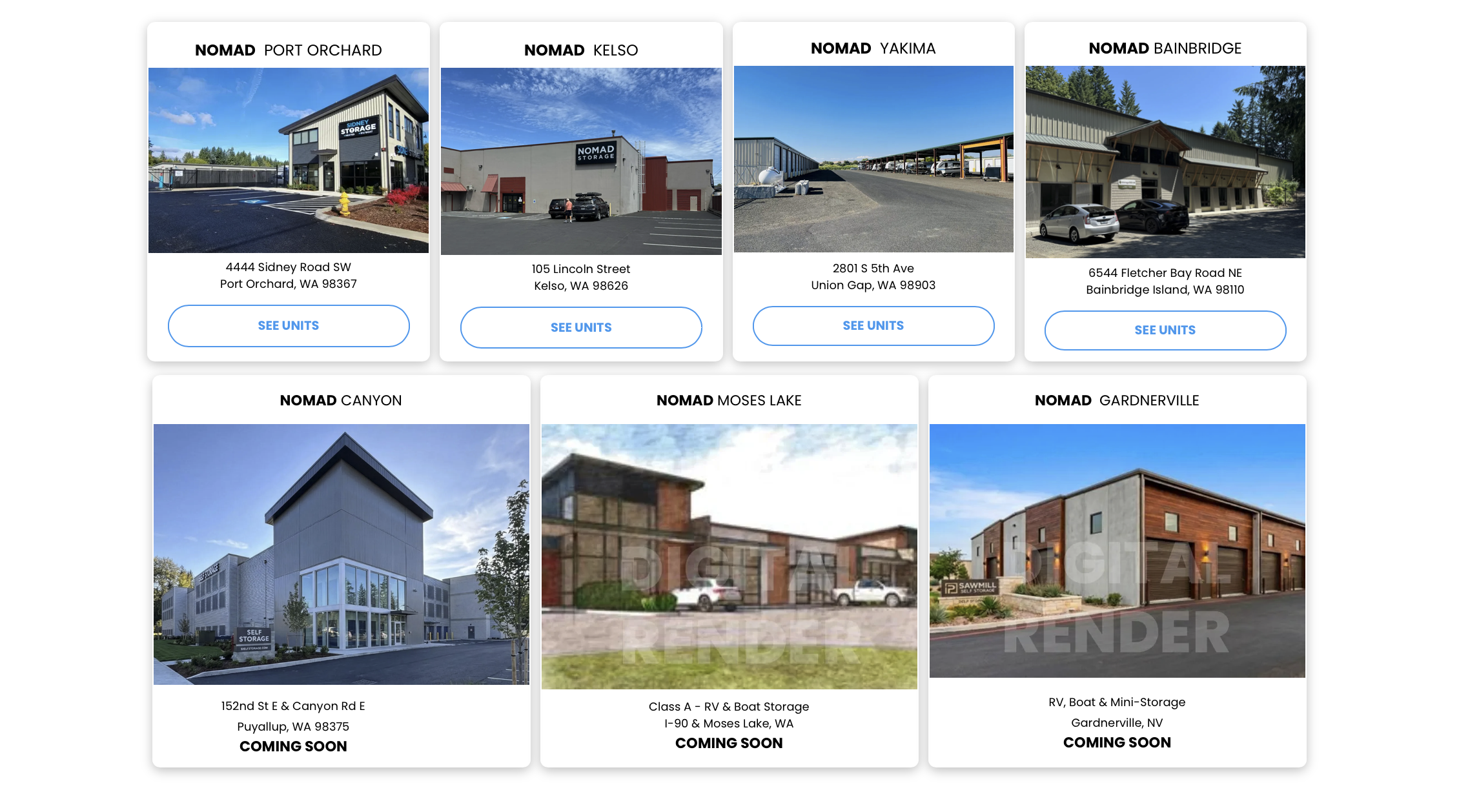

PROJECT DETAIL: NOMAD YAKIMA

RV, BOAT & MINI-STORAGE

Pagurian acquired a 15Acre RV storage facility in Yakima Washington through a preferred equity investment that generates impressive near-term cashflows along with liquidity and capital protections to investors. NOMADSTORAGE (our in-house management company) has assumed control and begun executing our operational improvement plan. | CLOSED Q4 2023

PROJECT DETAIL: NOMAD KELSO

MULTI-LEVEL MINI-STORAGE WAREHOUSE CONVERSION

70,000 SF self-storage conversion project in WA State. This size began as a Pepsi Bottling Factory in the early 1990’s but was vacated when the family relocated operations to a new purpose built facility and sold the company back to Pepsi. PAGURIANPARTNERS identified the for sale warehouse as an ideal shell for a climate controlled mini-storage facility in the core downtown pedestrian district.

After receiving conditional use approval from the city we finalized plans to construct a 2-story facility within the original structure, minimizing build costs and reducing our time to market. | OPENED Q3 2024

PAST PROJECTS

Auburn Express

(62,000 NRSF)

Orchard Express

(61,500 NRSF)

Graham Express

(36,000 NRSF)

Meridian Express

(47,100 NRSF + 30,000 Expansion)

Chelan Express

(39,000 NRSF)

Wenatchee Express

(28,500 NRSF)

Steptoe Express

(27,500 NRSF) + Car Wash

Gage Park

(28,000 NRSF)

Spanaway Express

(60,600 NRSF + Expansion)

Kent Express

(46,000 NRSF)

South Hill Express

(47,500 NRSF)

Everett Express

(20,000 NRSF)

Yakima Express

(25,000 NRSF + 1.5 Acre Expansion)

Pullman Express

(4.22 Acres)

Spokane Express

(25,000 NRSF)

Lacey Express

(23,000 NRSF)

Town Tub Car Wash

Chelan Station

(5.7 Acres)